Five expect this to happen in as little as a year. Nine believe it will take longer:

- The median prediction is that unemployment will peak at 6.5 percent, and will likely happen in the 4th quarter of 2021;

- The median forecast for British GDP for 2021 was 4.6% vs. the previous estimate of 4.7%; for 2022, 5.7% vs. pre. 5,5%;

- None of the economists surveyed expect the Bank of England to make any changes to its monetary policy following its meeting on March 18.

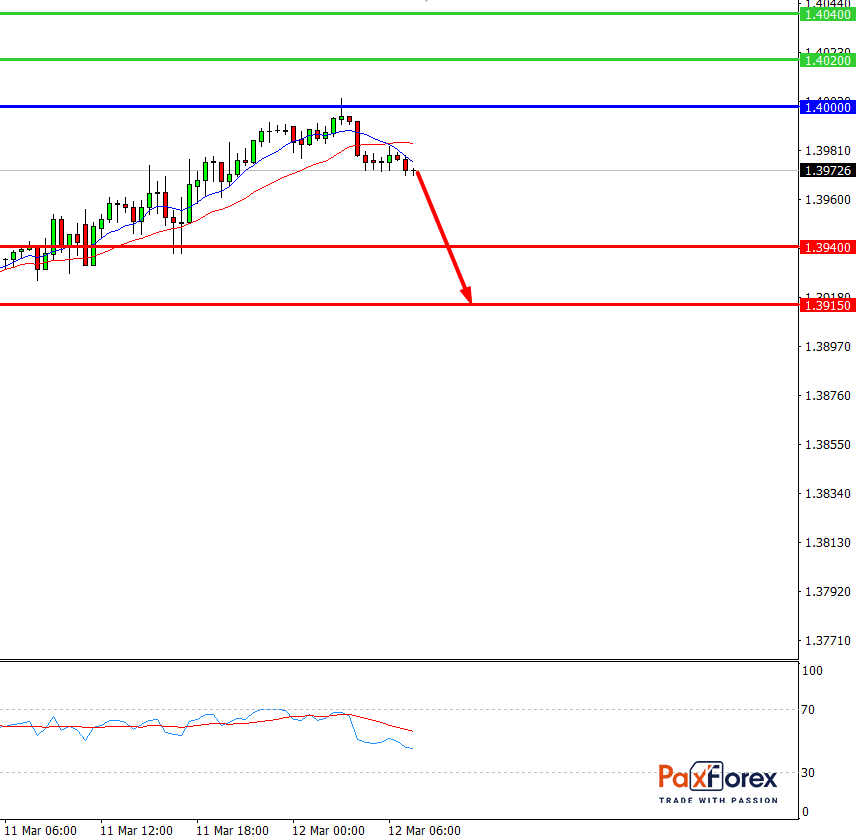

GBP/USD, 30 min

Pivot: 1.3973

Analysis:

Provided that the currency pair is traded below 1.4000, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 1.3973

- Take Profit 1: 1.3940

- Take Profit 2: 1.3915

Alternative scenario:

In case of breakout of the level 1.4000, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 1.4000

- Take Profit 1: 1.4020

- Take Profit 2: 1.4040

Comment:

RSI shows descending momentum during the day.

Key levels:

Resistance Support

1.4040 1.3940

1.4020 1.3915

1.4000 1.3900

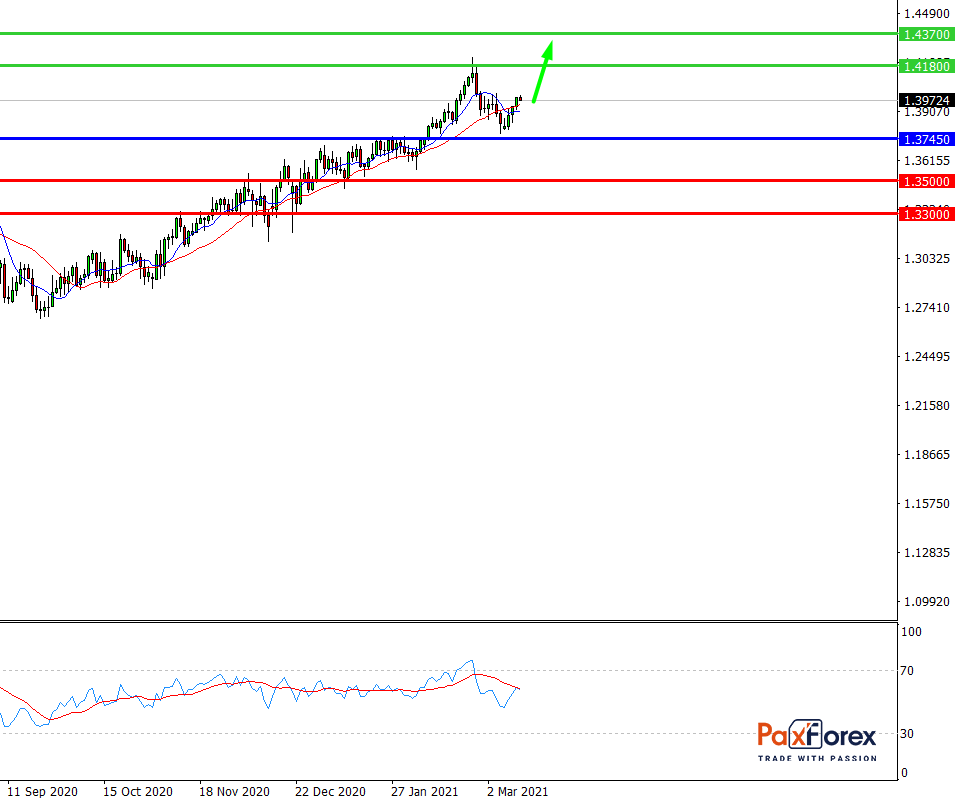

GBP/USD, D1

Pivot: 1.3933

Analysis:

While the price is above 1.3745, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 1.3933

- Take Profit 1: 1.4180

- Take Profit 2: 1.4370

Alternative scenario:

If the level 1.3745 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 1.3745

- Take Profit 1: 1.3500

- Take Profit 2: 1.3300

Comment:

RSI indicates that an uptrend continues in the medium term.

Key levels:

Resistance Support

1.4550 1.3745

1.4370 1.3500

1.4180 1.3300

USD/CAD Forecast Fundamental Analysis | US Dollar / Canadian Dollar

Prev article

EUR/JPY | Euro to Japanese Yen Trading Analysis

Next article

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis

ECB head Lagarde: so far we see no signs that inflationary pressures are becoming widespread.

GBP/JPY | British Pound to Japanese Yen Trading Analysis

GBP/JPY is declining from 2-week highs, approaching 151.50.